The construction industry has witnessed continuous growth in the last decade. Despite the economic condition, issues of supply chain management, and other obstacles, the equipment industry has grown substantially. Although the growth occurred globally however the global south saw a significant change in this regard. The demand for heavy construction equipment for instance cranes, motor grader, excavators, and others increased in emerging economies. Global South has experienced urbanization projects, infrastructure development, and growing investment in the construction sector.

Thus, it makes this region above all. In this scenario, the requirement for a robust motor grader has been maximized because of the increased number of interlinked road projects. The demand is expected to increase in the current year fueled by the need for better roads, efficient mining operations, and overall economic progress.

Increasing demand for development projects

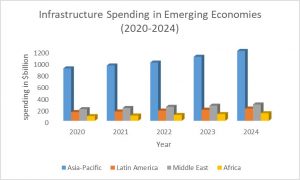

The principal factor that enhances the growth for heavy construction equipment in emerging economies is ongoing and coming projects. Throughout the global south and also in the Middle East there is a battling position scenario on development. North and Latin America were also on the same line, as Africa. All these regions emphasized enhancing the whole network of infrastructure including roads and highways.

The Global Infrastructure Outlook states that developing markets are expected to spend more than $4.6 trillion on infrastructure by 2040. This includes road development, which is closely related to the demand for motor graders. For example, India, Brazil, and South Africa are spending a lot on enhancing road networks to address the increasing transportation needs of their fast-growing urban populations.

Global Urbanization

Following the city to the right, the countries focus on urbanization. This has become a global trend and also contributes to increasing the demand for construction machinery. Developed and developing countries like Africa, Brazil, India, and other numerous nations accelerated urbanization rapidly. The United Nations projects that by 2030, there will be 1.8 billion more people living in urban areas in emerging nations. Heavy equipment including those used for extensive projects like motor graders and cranes is necessary. To guarantee effective and well-built cities the need for well-maintained roads and highways rises.

Mining Sector Growth

Following the construction sector, the mining industry is another side where heavy construction equipment is emerging. Many of these countries with the expansions in mining and an economic base feel they are economically better off with abundant natural resources. Motor graders are mostly used in mining, leveling work, and essential tasks to keep them operating and maintain efficiency.

The World Bank predicts an uptick in investments in mining in emerging economies by 3 to 4% over the period up to 2025. This would lead to more construction for improved access to mines and haul roads, where motor graders will play a critical role.

Motor Grader Market Growth in Emerging Economies (2020-2025) |

|||

|---|---|---|---|

| Regions | Growth Rate | Key Factors | Stats of the Investment |

| Asia-Pacific | The prominent sector of motor grader CAGR is estimated to be around 10% during the forecast period. | Road network upgrades, infrastructural development, and rapid urbanization | China accounts for 40% of the market share. India plans to construct 40 km of highways per day by 2025. |

| Middle East | Middle East growth rate is approximately 4.7% | Infrastructure development for the FIFA World Cup, Vision 2030, and general urban growth | Equipment growth in Saudi Arabia, Qatar, and UAE, driven by major events and ongoing infrastructure projects. |

| Latin America | Latin America witnessed a hike of 15% in construction equipment particularly in motor graders from 2020 to 2024. | Heavy infrastructure investments, road construction, and urban expansion | Brazil’s $65 billion investment. Mexico’s growing economy with a focus on rural roads. |

| Africa | The growth rate of motor graders in Africa is estimated to be around 4.5% annually with a significant demand for reconditioned graders. | Development and regional growth in countries like Kenya & South Africa | Rural development projects in Kenya, Nigeria, and South Africa. |

Regional Insights

Asia-Pacific

In the Asia Pacific region, China and India are the biggest market stakeholders in current times. Both China and India are emerging economies and their national infrastructure programs have just started. The particular region is expected to dominate this equipment market due to increased demand and growth of development projects.

More than 40% of the equipment market share in the region comes from China alone. The nation’s enormous Belt and Road Initiative (BRI) aims to construct roads and other infrastructure throughout Asia, Europe, and Africa. As a result, motor graders are becoming more necessary for road construction operations.

India is one of the biggest markets for road development worldwide. For motor grader producers, the Indian government’s goal of building 40 kilometers of highways every day by 2025 offers substantial potential. The road-building sector in India was estimated to be worth $7.4 billion in 2020 and is predicted to expand at a rate of 12–15% each year. It is anticipated that this expansion will keep driving up demand for motor graders.

Latin America

Countries such as Brazil and Mexico have heavily invested in infrastructure projects, building roads and highways, among others. Under the Growth Acceleration Program, the Brazilian government has committed $65 billion toward infrastructure funding, expected to drive demand for construction equipment, especially motor graders.

The economy of Mexico has been growing lately, which is complemented further by putting more emphasis on infrastructure improvements, hence resulting in the expectation for motor graders’ demand to grow, especially due to road-building projects in rural areas.

The Middle East

In the run-up to major international events like the 2022 FIFA World Cup in Qatar and the ongoing development of Saudi Arabia’s Vision 2030, the region is witnessing tremendous infrastructure development, pushed by nations like Saudi Arabia, the United Arab Emirates, and Qatar.

Construction equipment is in high demand as a result of this. Between 2020 and 2025, the Middle East’s construction equipment market is anticipated to expand at a compound annual growth rate (CAGR) of 5.5%, with motor graders being essential to road construction.

Market Challenges

Even with the encouraging growth, the market for motor graders in emerging economies has a number of challenges. One of the most significant is the expense of purchasing motor graders, which can be prohibitive for small contractors and companies. Another is the shortage of skilled operators and maintenance staff in some areas, which can restrict the efficient use of motor graders.

To meet these challenges, numerous manufacturers are placing emphasis on offering financing solutions and after-sales service, such as training programs to ensure that the operators can use and maintain these machines effectively. Caterpillar and Volvo are also launching more economical and efficient motor grader models, which are breaking cost barriers in emerging economies.